Madrid Apartment Prices

Marta Kowalczyk

1. Introduction

The Madrid real estate market exhibits diverse pricing dynamics influenced by factors such as local economic conditions, tourism, and urbanization rates. In the «Madrid Apartment Prices» project, I will focus on exploring regional differences in apartment pricing across various districts of Madrid.

Using SQL Server to analyze property listings, I will investigate how prices fluctuate between neighborhoods such as Aluche, Lavapiés-Embajadores, Tetuán, Puente de Vallecas, Carabanchel, Moncloa, Barrio de Salamanca and Chamberí, seeking insights into the factors that contribute to these regional disparities.

This analysis aims to provide a comprehensive understanding of the pricing landscape in Madrid, offering valuable context for investors and policymakers alike.

2. Data Description

The dataset was found on Kaggle (https://www.kaggle.com/datasets/mirbektoktogaraev/madrid-real-estate-market). It contains 29 columns and 21742 rows.

- id: A unique identifier for each real estate listing.

- title: The title of the property listing, typically summarizing key features.

- subtitle: Additional information or highlights about the property, providing more context. Districts.

- sq_mt_built: The total constructed area of the property in square meters.

- sq_mt_useful: The usable area of the property in square meters, indicating space available for living.

- n_rooms: The number of rooms in the property, including bedrooms and living spaces.

- n_bathrooms: The number of bathrooms in the property.

- raw_address: The complete address of the property, possibly including street, city, and postal code.

- street_name: The name of the street where the property is located.

- floor: The floor number on which the property is situated, indicating if it’s on the ground level or higher.

- operation: The type of transaction, such as rent or sale.

- rent_price: The monthly rental price of the property.

- buy_price: The purchase price of the property.

- house_type_id: An identifier indicating the type of property (e.g., apartment, house, villa).

- is_renewal_needed: A boolean value indicating whether the property needs renovations or updates.

- is_new_development: A boolean value indicating if the property is part of a new development project.

- built_year: The year the property was constructed.

- has_central_heating: A boolean value indicating whether the property has central heating.

- has_individual_heating: A boolean value indicating if the property has individual heating systems.

- are_pets_allowed: A boolean value indicating whether pets are permitted in the property.

- has_ac: A boolean value indicating whether the property has air conditioning.

- has_fitted_wardrobes: A boolean value indicating if the property includes built-in wardrobes.

- has_lift: A boolean value indicating whether the building has an elevator.

- has_garden: A boolean value indicating if the property has a garden area.

- has_pool: A boolean value indicating if the property includes a swimming pool.

- has_terrace: A boolean value indicating if the property has a terrace.

- has_balcony: A boolean value indicating if the property has a balcony.

- energy_certificate: Information about the energy efficiency rating of the property.

- has_parking: A boolean value indicating whether the property includes a parking space.

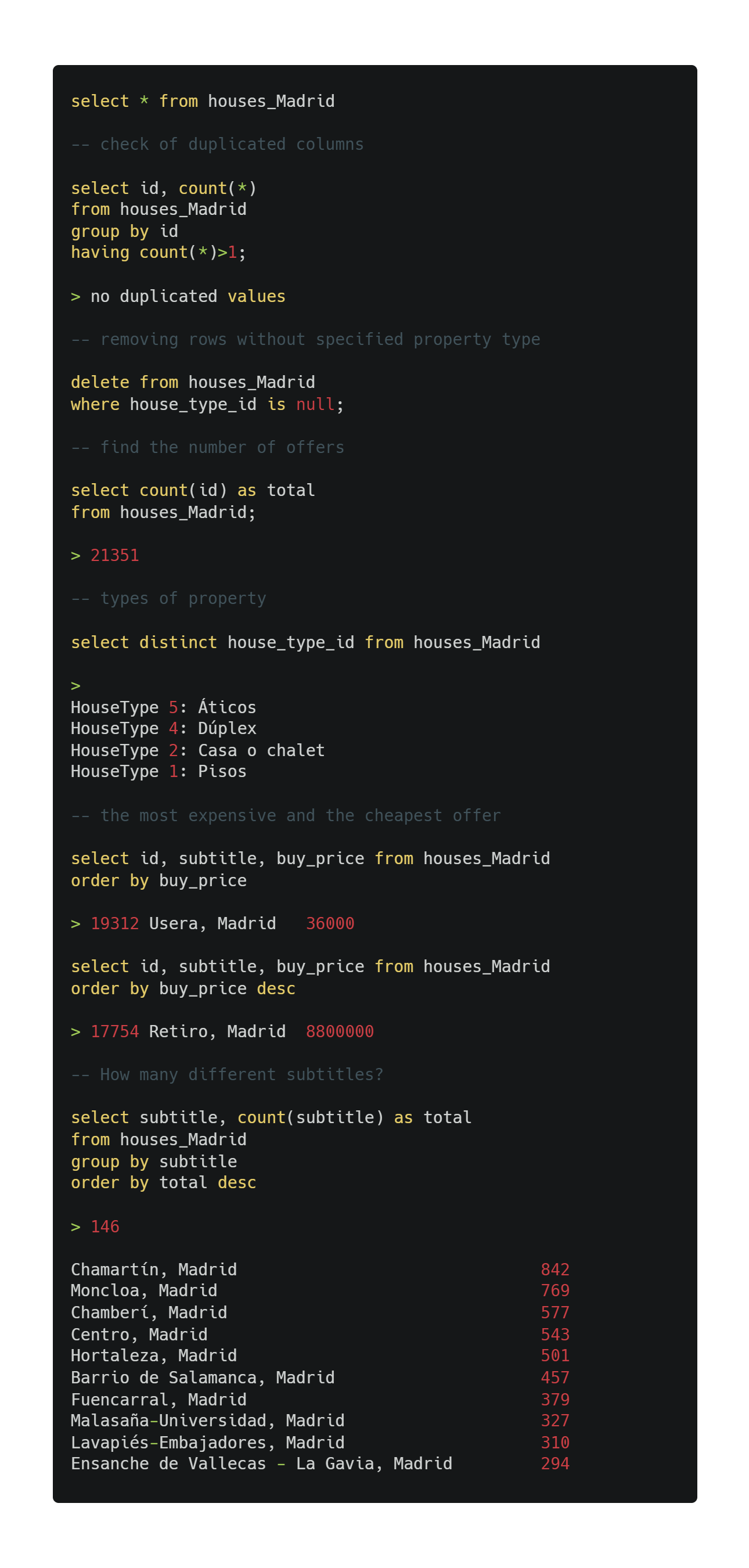

3. Data Exploration

Comment:

I will focus on flats (pisos) in Aluche, Lavapiés-Embajadores, Tetuán, Puente de Vallecas, Carabanchel, Moncloa, Barrio de Salamanca and Chamberí.

Lavapiés-Embajadores – Known for its bohemian vibe and cultural diversity. It has a rich history, but some parts are still considered less safe due to petty crime, particularly at night.

Tetuán – This area offers a mix of affordable housing with some pockets of wealthier developments. It’s a diverse, working-class district but can have areas that feel less safe, particularly in the south.

Puente de Vallecas – A neighborhood with a strong community vibe and affordable housing. It’s known for its working-class roots but also faces challenges related to crime and poverty in certain parts.

Aluche – A largely residential area with a multicultural feel and affordable living options.

Carabanchel – Traditionally a working-class area. It’s safe, though not a luxury area, and is popular with families and young professionals.

Moncloa – Known for its proximity to universities and government buildings, Moncloa attracts students and professionals. It’s a well-regarded, safe area with a mix of upscale housing and affordable options, but it’s not considered a luxury neighborhood.

4. Data Analysis

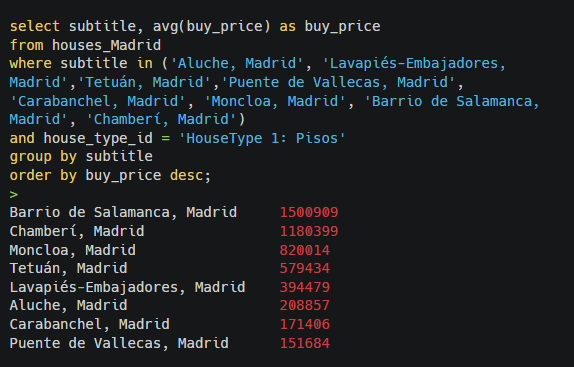

What is the average buy price of properties in each district?

Comment:

The results reveal significant price differences across Madrid districts. Barrio de Salamanca is the most expensive, with an average buy price around 1.5 million EUR, indicating its prestige. Chamberí and Moncloa follow but at lower prices. In contrast, Aluche, Carabanchel, and Puente de Vallecas have the lowest averages (151.7k–208.8k EUR), suggesting more affordable housing options.

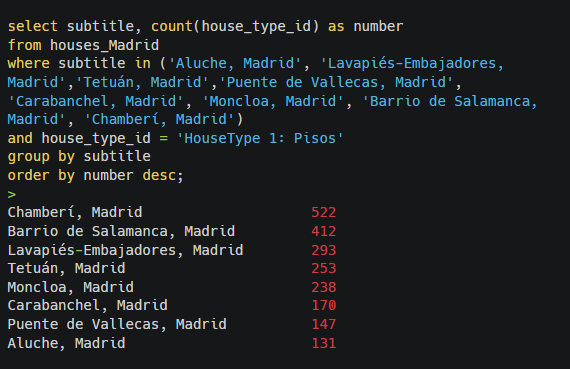

What is the the number of properties for sale in each district?

Comment:

The results reveal significant price differences across Madrid districts. Barrio de Salamanca is the most expensive, with an average buy price around 1.5 million EUR, indicating its prestige. Chamberí and Moncloa follow but at lower prices. In contrast, Aluche, Carabanchel, and Puente de Vallecas have the lowest averages (151.7k–208.8k EUR), suggesting more affordable housing options.

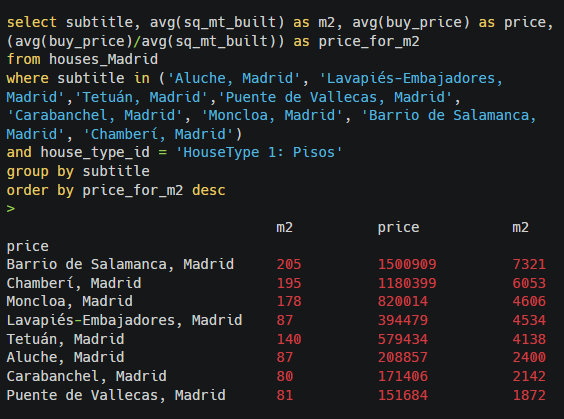

Which districts have the highest average m2 built for properties and what are the average prices for m2?

Comment:

The data shows that Barrio de Salamanca offers the largest average property size at 205 m², followed closely by Chamberí with 195 m² and Moncloa at 178 m². These districts also have the highest prices per square meter, with Barrio de Salamanca at 7,321 EUR/m² and Chamberí at 6,053 EUR/m², suggesting these areas are among the most exclusive in Madrid.

In contrast, Lavapiés-Embajadores and Tetuán have moderately lower property sizes (87 m² and 140 m², respectively) and more accessible prices per m², around 4,534 EUR and 4,138 EUR. Aluche, Carabanchel, and Puente de Vallecas offer the smallest average sizes (80–87 m²) and the lowest prices per square meter, ranging from 1,872 EUR in Puente de Vallecas to 2,400 EUR in Aluche, making these districts more affordable for buyers.

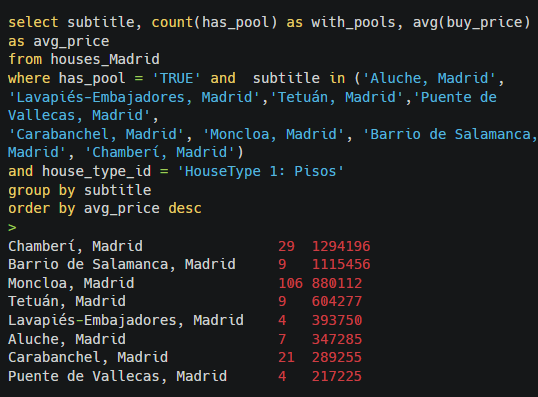

How many properties in each district have pools, and what are their average prices?

Comment:

In terms of properties with pools, Moncloa leads both in the number of properties (502) and average buy price (€1,834,219), indicating a substantial presence of high-value homes with this feature. Other affluent districts like Barrio de Salamanca and Chamberí also have properties with pools, though in lower numbers (15 and 46, respectively) and high average prices (€1,690,651 and €1,671,200). More affordable neighborhoods like Puente de Vallecas and Aluche have very few properties with pools, and the average prices here remain considerably lower, underscoring a correlation between pool amenities and property values.

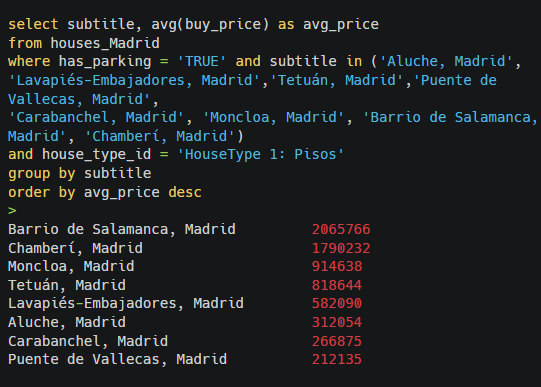

What are the average prices for properties with a parking?

Comment:

The results indicate that properties with parking are most expensive in Barrio de Salamanca (average price ~2.07 million EUR) and Chamberí (~1.79 million EUR), reinforcing these districts’ premium status. Moncloa and Tetuán follow with average prices of ~914k EUR and ~819k EUR, making them more moderately priced.

In contrast, Aluche, Carabanchel, and Puente de Vallecas offer more affordable options, with average prices ranging from ~212k EUR to ~312k EUR. This distribution highlights substantial price differences tied to district prestige and parking availability.

How does the average price per square meter differ between new and older buildings?

Comment:

The data reveals that new developments tend to have higher average prices per square meter compared to older buildings across most districts. For example, in Aluche, the price per m² for new developments is 3,031 EUR, compared to 2,405 EUR for older properties. Similarly, in Carabanchel, new properties average 2,725 EUR per m², while older buildings are around 2,144 EUR.

In premium districts like Barrio de Salamanca, the price per m² for older properties remains high at 7,309 EUR, though data on new developments there is not provided. Chamberí also maintains high prices, with older buildings averaging 6,061 EUR per m².

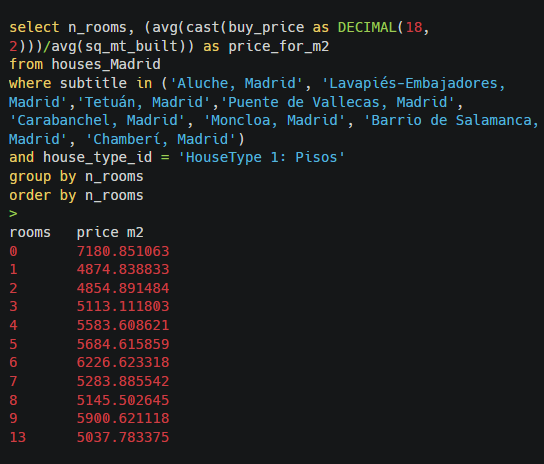

What is the relationship between the number of rooms and the price per square meter?

Comment:

The data suggests a general trend where properties with more rooms tend to have a higher price per square meter, although this trend is not strictly linear.

Properties without rooms (likely studios or open-plan apartments) have the highest price per m² at ~7,181 EUR, which may reflect premium locations or high demand for such configurations.

For 1 to 3-room properties, the price per m² is relatively stable, averaging around 4,854 to 5,113 EUR, showing moderate demand.

From 4 to 6 rooms, there’s a noticeable increase, with prices per m² reaching ~5,584 to 6,227 EUR, likely due to the appeal of larger spaces for families.

After 6 rooms, the price per m² varies, with some larger properties (like 9 rooms) averaging ~5,901 EUR per m², while the trend becomes less consistent as room numbers increase, possibly due to fewer data points or unique property features in these cases.

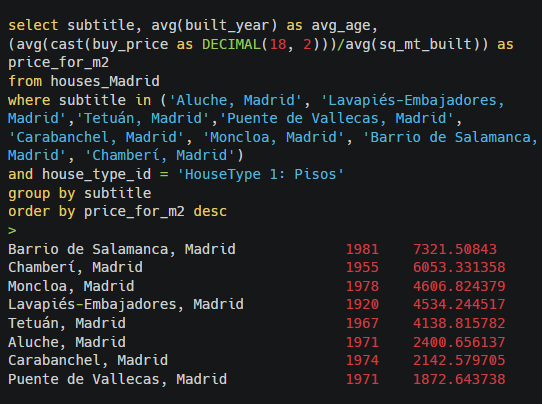

What is the average age of buildings by district, and does it affect the price per square meter?

Comment:

In Madrid, newer buildings often have higher prices per square meter, particularly in prestigious districts:

Barrio de Salamanca (1981) and Chamberí (1955) lead with the highest prices per m² (~7,321 EUR and ~6,053 EUR).

Moncloa (1978) and Lavapiés-Embajadores (1920) also maintain high prices per m² (~4,607 EUR and ~4,534 EUR), despite Lavapiés having older buildings, likely due to its central location.

In more affordable areas like Aluche, Carabanchel, and Puente de Vallecas (1971–1974), prices per m² are lower (~1,873–2,400 EUR), reflecting both older buildings and less central locations.

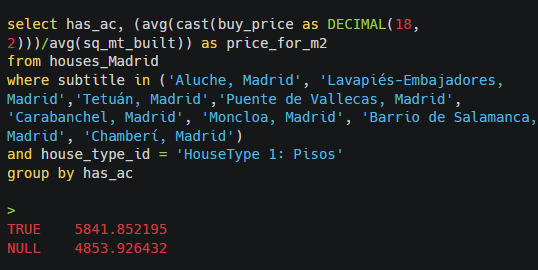

How do the prices per square meter compare between properties with and without air conditioning?

Comment:

Properties equipped with air conditioning show a higher average price per square meter (€5,841) compared to those without (€4,853). This indicates a premium associated with air conditioning, suggesting that buyers may value this feature for its added comfort, especially in warmer months.

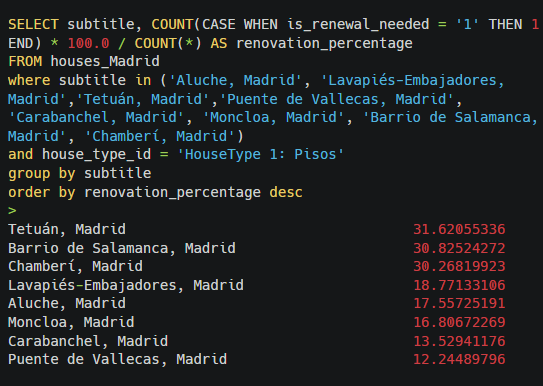

In which districts are there the highest proportions of properties that need renovation?

Comment:

Tetuán, Barrio de Salamanca, and Chamberí have the highest proportions of properties requiring renovation. This may reflect a mix of older buildings in these neighborhoods or properties where renovations could add significant value. In contrast, Puente de Vallecas and Carabanchel show the lowest proportions of properties needing renovation. This suggests that properties in these districts may either be more modern or already updated, appealing to buyers seeking move-in-ready options.

5. Conclusions

Price Variability by District:

Luxury districts such as Barrio de Salamanca, Chamberí, and Moncloa consistently demonstrate the highest property prices, both in terms of overall value and price per square meter, confirming their status as high-demand areas with premium amenities. Conversely, districts like Puente de Vallecas and Carabanchel offer more affordable options, making them attractive for budget-conscious buyers.

Property Features and Added Value:

Properties with air conditioning are priced higher on average per square meter, highlighting the added value of modern amenities. Similarly, properties with features like parking or a pool also show increased average prices, indicating these attributes’ appeal to buyers and their positive influence on property values.

Impact of Property Age:

Districts with older properties, such as Lavapiés-Embajadores and Chamberí, exhibit lower average square meter prices compared to newer buildings in areas like Moncloa. The overall trend suggests that newer constructions, or modernized properties, generally attract higher prices per square meter due to updated infrastructure and design standards.

Demand for Renovations:

High proportions of properties needing renovations in districts like Tetuán and Barrio de Salamanca may offer investment opportunities, as properties in these areas have potential for added value through upgrades. Districts with fewer renovation needs, such as Puente de Vallecas, indicate a trend toward already modernized or newer homes, appealing to buyers seeking ready-to-move-in properties.

Size and Room Count:

The observation that properties with fewer rooms have higher prices per square meter can be true in high-demand areas where smaller units are located centrally. However, the lower price per square meter for larger properties is accurate; they often serve larger families or individuals seeking more space, typically found in less central areas. It’s important to note that this trend can also reflect market dynamics, where smaller, higher-value units in prime locations drive up per square meter costs.